Why we tripled down on Homeville

Riverwalk's thesis of tripling down in Homeville's $15 million Series A

Housing is an emotional need

Roti, Kapda, Makaan! The three necessities of life. Despite the arguments laid by fin-fluencers debating the practicality of renting vs buying, living in the house you own is a special feeling. It's a feeling of safety and security that is cherished by all Indians.

With a large TAM and a very clear why now!

India’s housing finance market is entering a super cycle and represents a $1 trillion opportunity over the next decade.

Homeville is a pioneer in Housing Finance with a fundamentally superior approach

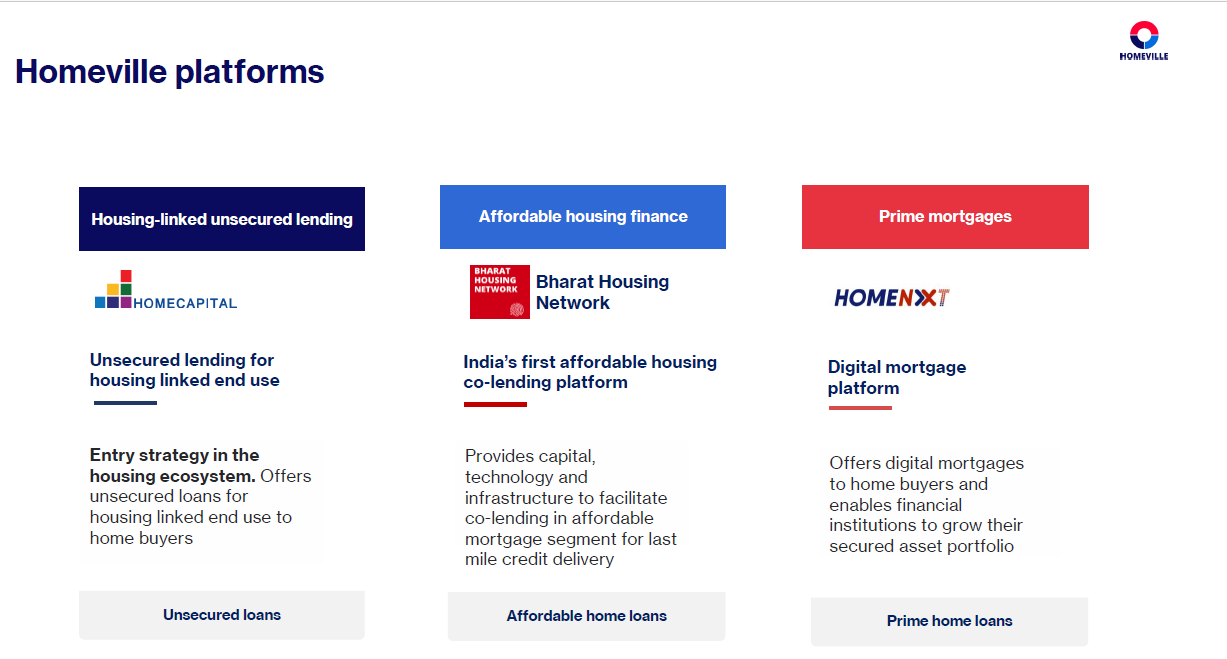

Homeville is accelerating home ownership through its innovative and unique credit platforms and infrastructure – HomeCapital, Bharat Housing Network and HomeNxt, through which the company covers the entire housing finance value chain.

HomeCapital: Credit for housing linked end-use like - down payment finance, stamp duty registration, home interiors, etc.

Bharat Housing Network: Co-lending infrastructure for affordable housing.

HomeNxt: Embedded mortgages across digital ecosystems

These platforms function as essential infrastructure, lowering distribution and operations costs for financial institutions, resulting in a seamless flow of capital into housing.

Homeville follows a hybrid approach using Platform + Capital. Both are critical ingredients for building a highly scalable financing company that increases ROE along with growing AUM.

Platforms enable distribution, coverage, and scalability, which helps generate fee income from partners, increasing ROE.

Capital (through the captive NBFC) enables higher NIMs, control over the customer, and greater flexibility.

Today, through Homeville’s platforms, the largest real estate developers and financial institutions (banks, HFCs, and NBFCs) are able to partner and work seamlessly with each other. The power of the platform is already evident as 2nd order network effects become visible, resulting in a faster scale-up of partnerships and disbursements across the housing value chain.

Virtuous cycle underway

Cash is the raw material for lending businesses, and all financial institutions follow a virtuous cycle linked to scale. Homeville’s tech platforms act as an additional lever, magnifying the impact of this virtuous cycle.

With the foundation being set, the USD 15 million (INR 125 cr) infusion will entirely be used to pursue growth and puts the company well and truly on the path of >$1 Billion in disbursements in the next 3 years.

Witnessing Lalit, Madhu, Prasad and the Homeville team in action over the last 5 years has been super fulfilling and has evolved how we think about fintech businesses at Riverwalk. The Homeville team’s ability to identify gaps, launch innovative products, and continuously expand TAM has been extraordinary.

Riverwalk is honored to have been one of the earliest investors in Homeville and to play a small role in this journey to help every Indian become a proud homeowner.

Disclaimer: This content is for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers for those matters. References to any companies or securities do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors